What’s Up? The Debt Ceiling

John Martinious the Third helps explain to us this morning the debt ceiling!

February 28, 2023

Another fight has reared its head on Capitol Hill as the United States speeds towards reaching the national debt limit, or debt ceiling. Senators are bickering and debating whether or not to raise the ceiling even further, for the first time since 2019, which would further increase the U.S. borrowing limit to even greater heights.

But why should the average American, let alone OSOTA scholars, care about federal borrowing limits and financial deliberations hundreds of miles away? What even is a debt ceiling and what does it do? To learn more, I talked to our very own economics teacher, John Martinous III, for more details.

“In theory, the ceiling works like this: Congress passes laws and allocates resources, but usually passes more laws than there is money in the budget, so they have to take on debt and obtain funds from selling bonds to the public. This is essentially a promise that the government will pay them back in the future, and we gain debt. Every year, the president passes a budget plan and says, ‘These are the laws that have already passed, and here is how much money we need to fund them.’ However, as we pass new laws throughout the year that we have not budgeted for, we need to take on debt to fund those new laws. That being said, the debt ceiling is a limit on how much the government can borrow to spend on legislation in a year. The United States is actually one of only two countries that still have a debt ceiling; the only other nation is Denmark, but their debt ceiling is so high that it would be nearly impossible to reach. So, we are really the only nation left in the world that routinely goes into crisis over whether or not, basically, to pay debt.”

But why do we even have a debt limit to begin with, and what purpose does it serve now? According to the congressional research services paper entitled, Reaching the Debt Limit: Background and Potential Effects on Government Operations, “ Congress created a statutory debt limit in the Second Liberty Bond Act of 1917.8 This development changed Treasury’s borrowing process and assisted Congress in its efforts to exercise its constitutional prerogatives to control the federal government’s fiscal outcomes. The debt limit also imposes a form of fiscal accountability that compels Congress and the President to take deliberate action to allow further federal borrowing if necessary. “

It is important to note that this act was passed during the first world war where the United States needed money quickly to help raise and maintain their fighting force. Up until then congress was the power who approved every borrowing decision so to save time and keep the war moving, congress passed the debt limit so the treasury can borrow as much as they need to keep America and the war moving. Now that we are no longer at war how does it affect our government function?

Mr. Martinous responds, “So this is why I say in theory. The debt ceiling is something that falls apart once the levers of government are no longer used for cooperation, like how the filibuster in theory is used to halt to many bills being passed to quickly but in practice it is used for the minority party make the majority party to have 60 votes to get anything done, I think the debt ceiling is similar, it’s just a way for congress to get leverage over the president, and this happens no matter who is in charge. But it is also used to make it seem like congress got something done, it gets a lot of publicity, a lot of media coverage.”

So then, what happens if we, as a nation, default on our debt? Mr. Martinous had an answer to this as well: “If Congress does not raise the ceiling and we default, that means government employees will not be paid, soldiers will not be paid, social security checks will not come in, and Medicare, everything that is funded by the government, will be shut down. The FDA cannot inspect food, etc. It would be catastrophic. The private sector would also be affected because there would not be a currency reliable enough to trade with, making other competing currencies like the Yuan more appealing for investors. It would be catastrophic for the entire economy. I also find it important to mention that this is, at its end, a domestic issue. 66% of the U.S. debt is to itself in bonds, not in foreign investments like you might hear in the news.

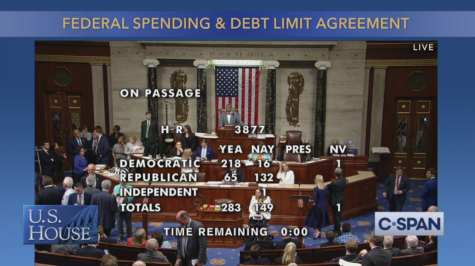

Earlier this month, the U.S. Department of Treasury released a statement urging lawmakers to advance the debt ceiling. “Congress has always acted when called upon to raise the debt limit. Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presidents and 29 times under Democratic presidents. Congressional leaders in both parties have recognized that this is a necessity.”